Maximizing Your LUNA: 22-30% APY Opportunities on TERRA

Written on

Introduction to LUNA Farming

After exploring various farming avenues on Terra, I felt compelled to delve deeper into a promising opportunity I've recently discovered.

Understanding the Strategy

In this piece, I'll outline the farming opportunity and guide you through the deposit process using LUNA, making it straightforward for you to follow. Additionally, I’ll briefly touch on the associated risks to help you assess whether this strategy aligns with your investment goals.

Why Pursue This Strategy?

While staking LUNA yields roughly 7% annually, there are possibilities of achieving 20-30% APY through this approach. Astroport is gaining significance, and this strategy allows you to farm ASTRO tokens. You'll also learn about bLUNA arbitrage and the application of smart contracts. Notably, 50% of your LUNA can be unbonded and converted to bLUNA when favorable opportunities arise.

Let's Begin!

You may be aware that you can pool LUNA and staked bonded LUNA (bLUNA) on Astroport. Currently, this pool offers around 16% APR. However, the APR is significantly influenced by the value of the reward token, $ASTRO, which has decreased due to recent Bitcoin fluctuations.

This pool presents minimal risk of impermanent loss, as LUNA and bLUNA tend to trade closely due to the ability to unbond bLUNA at a 1:1 rate over 21-24 days via the Anchor Protocol.

Enhancing Your Yield

Currently, rewards are primarily distributed in $ASTRO, which are not automatically compounded. To optimize this yield, consider using the Spectrum Protocol, a yield optimizer for Terra. By utilizing their bLUNA-LUNA vault, you can achieve approximately 22% APY, surpassing the 14-16% offered by Astroport alone.

Various Strategies Available

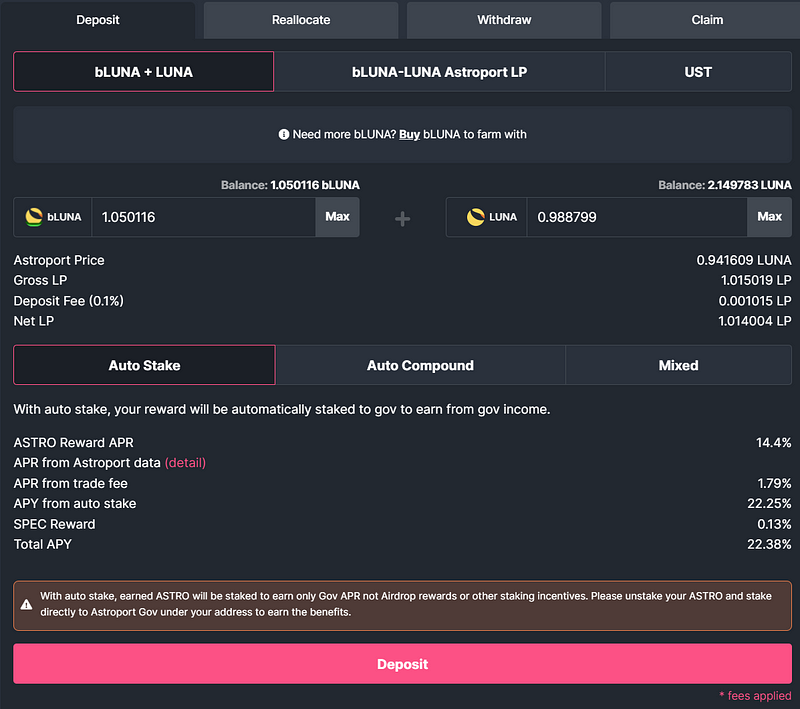

Spectrum offers two main strategies:

- Sell your ASTRO rewards and reinvest in bLUNA-LUNA LP (auto-compounding) for an overall return of 17.68% APY.

- Stake your ASTRO rewards as xASTRO, achieving an overall return of 22.38% APY while building a position in ASTRO.

I am personally opting for Strategy 2 due to its higher returns and my intention to increase my ASTRO holdings in anticipation of future Astroport features, such as token locking and the Retrograde launch.

Step-by-Step Guide

- Ensure you have LUNA in your wallet. If you possess UST, you can directly enter the strategy in Step 3.

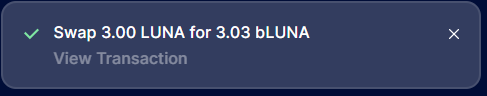

- Navigate to Astroport and convert 50% of your LUNA into bLUNA.

Typically, this process yields more bLUNA, forming the crux of the bLUNA arbitrage strategy. For quick price checks on bLUNA versus LUNA, refer to @arbitthebot on Telegram.

- Enter the vault with your LUNA and bLUNA.

When entering the vault, you can select the strategies mentioned earlier. "Auto Stake" corresponds to Strategy 2, while "Auto Compound" aligns with Strategy 1. A mixed approach is also available.

In the "Auto Stake" option, your ASTRO will be staked on your behalf. However, be aware that this will exclude you from receiving Airdrop rewards or other benefits. To qualify for those, you must manually claim and stake your ASTRO.

- Hit "Deposit" and you're set!

Managing Your Rewards

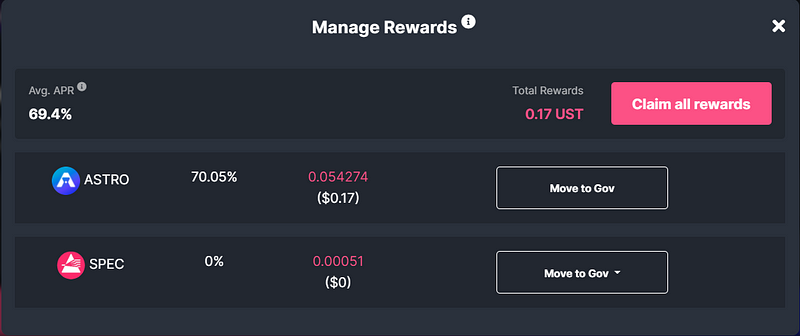

Your Vault Dashboard on Spectrum allows you to manage your rewards efficiently. You can either claim them to your wallet or choose "Move to Gov," which stakes your ASTRO as xASTRO under your own address. Only after this step will you be eligible for Airdrops or other staking incentives, positioning you as the staker instead of the Spectrum Smart Contract.

Understanding the Risks

- Smart contract risks associated with the Spectrum Protocol

- Risks linked to bLUNA implementation and the relatively stable price of bLUNA/LUNA

- Returns are contingent upon the performance of the ASTRO token

Conclusion

In this guide, you’ve learned how to stake your LUNA for potential returns of 20-30% APY while earning ASTRO rewards that may prove beneficial in the future (no financial advice, of course; it's perfectly fine to opt for pure LUNA rewards through autocompounding).

Should you have any suggestions or questions, feel free to reach out. If you enjoyed this article, consider sharing it with a friend, giving it a clap, and providing feedback.

Join the conversation here or connect with me on Twitter. Also, be sure to explore my other articles.

My Set of the Day:

Thank you for your time,

n1ce

If you wish to further support my work, consider subscribing to Medium through my link (click here). I will receive a small fee without any extra cost to you.

Join the Coinmonks Telegram Channel and YouTube Channel to learn about cryptocurrency trading and investing.

Also, check out my other articles on various topics related to crypto trading and investment strategies.