Exploring Bitcoin as an Inflation Hedge in 2024

Written on

Chapter 1: The Arrival of Q2

As April unfolds, Bitcoin is showing a steady upward trend. Looking back, it has increased roughly 20% from its lows in March and nearly 30% since the onset of the conflict in Ukraine.

With Q2 now underway, Bitcoin seems well-positioned for another potential surge towards the $50,000 mark in the upcoming weeks. I have been predicting that this quarter could yield significant movements for Bitcoin.

Presently, Bitcoin's price is roughly stable for the year, re-establishing itself for a potential upward trajectory. Given the tumultuous global landscape, this is quite remarkable.

Recent discussions have reignited the ongoing debate about Bitcoin's role as a hedge against inflation. With inflation becoming a hot topic, let's explore this further.

Section 1.1: Understanding Inflation

Inflation signifies a general increase in the prices of goods and services. Typically, rising inflation is accompanied by a decline in the purchasing power of the local currency.

As prices escalate, the value of each currency unit diminishes, resulting in fewer goods and services being accessible. Over time, inflation amplifies the cost of living.

Subsection 1.1.1: Traditional Inflation Hedges

In times of rising inflation, cash or local currency is not the most prudent choice for wealth preservation. Common alternatives include gold, real estate, and stocks.

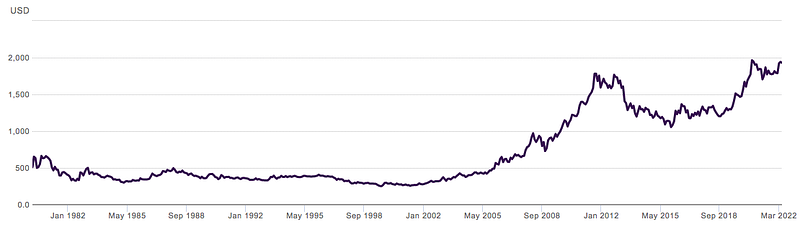

Gold: Gold has a long-standing reputation as a reliable hedge against inflation. Its desirability spans thousands of years. However, it often struggles to perform in the short term as an inflation hedge. For nation-states, gold may be ideal, but for individuals, its price volatility can be problematic.

In the 1980s, gold prices soared before plummeting significantly within two years, only to trade negatively until 2000. Between 2000 and 2012, gold saw a near sevenfold increase, but by 2016, prices had again halved.

Since 2016, gold has rebounded from its previous decline, yet it continues to experience substantial short-term fluctuations. Thus, the question arises: Is gold a reliable hedge against inflation?

This is a complex issue. Governments and institutions often turn to gold for inflation protection due to its long-established credibility. They have a well-practiced understanding of how to acquire and store this asset.

Real Estate and Stocks: Both real estate and stocks are also considered traditional hedges against inflation. However, their value is significantly influenced by geographic and external factors. The financial crisis of 2007-2008 highlighted that even robust economies can falter, while gold approached its all-time high during that period.

Section 1.2: The Bitcoin Perspective

So, how does Bitcoin compare as an inflation hedge?

Bitcoin emerged in the wake of the financial crisis and, while still relatively young compared to gold, real estate, or stocks, it has rapidly established a presence in the digital economy.

As a digital asset, Bitcoin exhibits some inflation-hedging characteristics akin to gold, real estate, and stocks, although it aligns most closely with gold.

Digital Gold: Bitcoin is often referred to as “digital gold” as it serves as a store of value, not tied to any government and characterized by its scarcity. Unlike gold, Bitcoin's supply is finite; once it reaches its maximum limit, no additional coins will be produced.

Moreover, Bitcoin's digital nature allows for easy division and transfer across the globe, enhancing its appeal as a modern asset.

Bitcoin as a hedge against inflation and its role in a digital economy.

Hedge or Not?

The pressing question: Is Bitcoin an effective hedge against inflation? To date, Bitcoin has shown promising performance in this regard, consistently maintaining purchasing power since its inception.

However, its relatively brief history leaves us uncertain about its long-term inflation-hedging capabilities over decades. I maintain an optimistic view, while others suggest Bitcoin could emerge as a significant reserve asset.

Bitcoin is continuously reaching new milestones in terms of market capitalization and transaction volumes, often surpassing countries and corporations. Its competition with gold for the title of the best store of value asset is heating up.

Will the floodgates open for Bitcoin?

This remains a pivotal question. Bitcoin possesses unique qualities that position it as both a store of value and a medium of exchange. As inflation escalates globally, these unique attributes will likely become even more pronounced.

Conclusion

As we enter Q2, Bitcoin stands on solid ground. I anticipate it will reclaim the $50,000 mark before the end of April. Nearly a year has passed since Bitcoin peaked above $60,000.

Last April, Bitcoin surged to record highs exceeding $60,000 coinciding with Coinbase's public listing. Although it faced a downturn post-listing, it eventually reached new highs again in late 2021.

Even at current price levels, I consider Bitcoin to be in a historically high range, as it has only traded above $50,000 or $60,000 for a brief duration. Any price above these levels is uncharted territory.

New all-time highs could be on the horizon for 2022, although they will likely come with increased volatility.

Thank you for reading! Please note that I am not a financial advisor, and this is not investment advice. All views expressed are solely my own. For more insights like this, consider subscribing to my weekly newsletter.

Parker Lewis discusses whether Bitcoin can serve as an inflation hedge.