Unlock Up to 11% APY with hi Flexible Earn: A Comprehensive Guide

Written on

Chapter 1: Introduction to hi Flexible Earn

In the face of regulatory uncertainties, the cryptocurrency market is increasingly attracting investments. Prominent business leaders are also diving into this burgeoning industry. Accessing the crypto market has become significantly easier than it was in the past.

Numerous key players in the blockchain sector are creating their own crypto banking applications to help newcomers navigate this space. One notable example is Sean Rach, the former Chief Marketing Officer of Crypto.com, who co-founded the user-friendly online crypto banking platform, hi. This platform aims to provide an engaging blockchain experience for its users.

Many traders may feel apprehensive about investing in cryptocurrencies due to market volatility. However, not every cryptocurrency experiences extreme fluctuations. Some investors choose to maintain a reserve of stablecoins during periods of market instability or for trading purposes. While the price changes of stablecoins tend to be minimal, the choice of where to store them to maximize their value is crucial. At hi, users can earn up to an impressive 11% APY on their stablecoins!

In this article, I will explain how the hi Flexible Earn program functions and how you can earn up to 11% APY on your savings. Additionally, I will compare hi with other crypto applications to provide deeper insights.

Section 1.1: Understanding hi Flexible Earn

The process is straightforward. Users can deposit USDT or ETH into hi to earn up to 11% APY in-kind. While many crypto platforms offer higher annual percentage yields (APYs) compared to traditional banks, they often come with complex terms and conditions, such as extended lockup periods or restricted withdrawals, which can create insecurity for users.

hi is designed to transform the crypto landscape and is on track to become a market leader. It not only offers exceptional interest rates on investments but also allows users to earn without any lockup period. This is the essence of hi Flexible Earn!

Section 1.2: Features of hi Flexible Earn

Did you know that traditional banks typically offer just 0.5% interest on savings, which is at least ten times less than what hi Flexible Earn provides? Furthermore, with its secure policies, users can trade without fear of falling victim to scams or hacks.

- Earn Up to 11% APY: hi Flexible Earn now supports stablecoins like USDT and ETH. By simply transferring USDT to hi, users can earn 11% APY in-kind, meaning the yield is paid out in USDT.

USDT, also known as Tether, is a fiat-collateralized stablecoin pegged to several fiat currencies, including the USD, Euro, and Pound, at a 1:1 ratio. In simpler terms, 1 Tether is equivalent to 1 USD. For users holding ETH in hi Flexible Earn, they can earn 5.5% APY in-kind on their Ethereum deposits.

- Flexibility with No Fees or Lockup: While several online crypto platforms offer average interest rates, they often impose hidden fees or require lengthy lockup periods ranging from 50 to 365 days. In contrast, hi Flexible Earn allows members to withdraw their earnings instantly without any lockup conditions.

- Weekly Yield Payments: Wouldn't it be great to see your yield credited to your account every week? With hi Flexible Earn, yields are disbursed in the same currency that was deposited. For instance, if you deposit 70 USDT, your yield will be paid out in USDT every Friday.

- Low Minimum Deposits: hi makes it accessible to experience this earning feature with a minimum deposit of just 50 USDT or 0.1 ETH. Once this amount is added to your savings, you can start earning through the platform.

Section 1.3: Comparing hi with Other Crypto Platforms

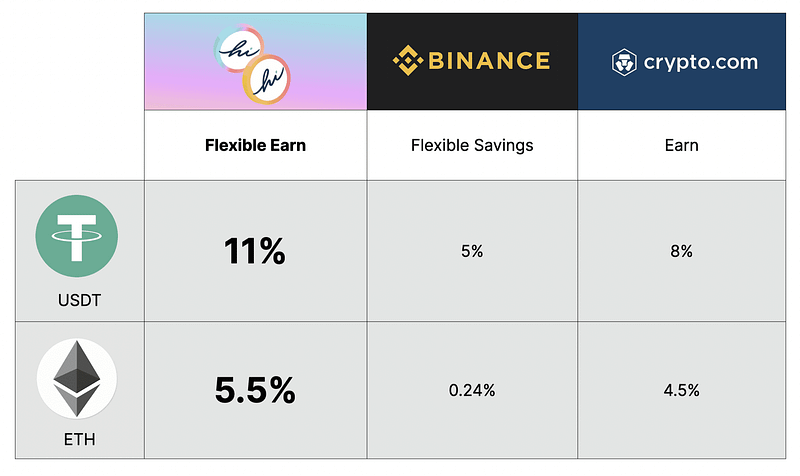

hi is quickly gaining traction as an online crypto banking app, boasting over 3.3 million members in its community. To better understand its competitive edge, let’s compare hi Flexible Earn with other platforms.

- Crypto.com: Unlike hi Flexible Earn, Crypto.com has been a centralized finance platform since 2016, offering 1.5% APY on USDT and 0.5% APY on ETH without a minimum deposit. Similar to hi, Crypto.com pays yields weekly.

- Binance: As a leading global crypto platform with over 26 billion users, Binance offers only 5% APY on USDT and 0.24% APY on ETH, charging withdrawal fees of $15 to $30. While it requires a minimum deposit of 10 USDT to open an account, its yields fall short compared to hi Flexible Earn.

Chapter 2: How to Get Started with hi

To start earning with hi Flexible Earn, follow these simple steps:

- Download the hi App (available for Android or iOS).

- Deposit a minimum of 50 USDT or 0.1 ETH to begin earning without any lockup.

The more you hold in hi, the greater your potential earnings. In addition to hi Flexible Earn, users can also explore its Fixed Term Earn option by holding the native token—HI—which offers even higher APYs along with membership perks, such as travel benefits and complimentary digital subscriptions.

The Bottom Line

hi Flexible Earn is an intuitive, flexible platform with competitive APYs. After comparing it with other crypto platforms, it's clear that hi Flexible Earn offers superior interest rates. Moreover, it is a trusted platform with over 3.3 million members.

Rabinder Kumar

August 2022

Stay updated! Subscribe for more intriguing stories directly to your email whenever I publish.

Discover how to earn passive income through crypto savings on Binance, featuring flexible and locked options with interest rates of up to 25%.

Learn about crypto staking and explore the potential for passive income through hi's Giga Pools, offering APYs exceeding 500%.