Is Ledger’s New Backup Service a Backdoor to Your Assets?

Written on

The Ledger Backup Dilemma

The crypto community is currently buzzing with concerns regarding Ledger’s latest offering. This new service appears to contradict two foundational principles in the cryptocurrency world:

- Self-custody is essential: If you don't hold the keys, you don't own the coins.

- Seed phrases must remain secure: They should never be entered on a device connected to the Internet.

Ledger's newly introduced feature, known as Recover, allows users to back up their seed phrases for a monthly fee, raising eyebrows across the sector.

Traditionally, cold wallets keep your assets away from online threats, allowing you to access your device at any time. You maintain sole control of your keys through a PIN and a seed phrase (comprising 12 or 24 words), which enables recovery of your assets in case the physical device is lost.

However, Ledger aims to shift this paradigm.

Ledger’s Controversial Feature

Ledger Recover offers users the ability to back up their secret recovery seed phrase for their cold wallet, the Nano X, in case of unforeseen issues. For a monthly subscription of $9.99, users gain this added layer of security for their digital assets.

How It Operates

The service divides your private key into three segments, each secured by different entities: Coincover, Ledger, and a yet-to-be-named independent backup service. Alone, these fragments are ineffective; at least two out of the three are needed to reconstruct your private key and access your wallet. This redundancy means that if one company fails, the other two can still provide access, with the third party being replaced as needed.

Although this feature is optional, many are apprehensive about its implications.

Why the Outcry?

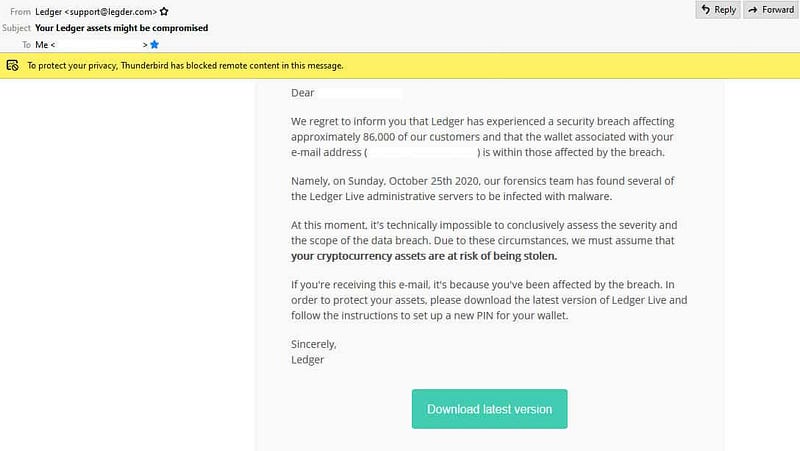

Some critics argue that this could create a backdoor to your assets. A Twitter user, foobar, expressed concerns that upgrading your Ledger device could unintentionally permit the sharing of your private key with third parties, even if this occurs via secure channels. Even for those who opt out of this service, the potential for the device to retain code facilitating such access poses risks, especially in light of Ledger’s past data breach.

In 2020, a significant hack exposed one million email addresses, along with names and physical addresses, leading to a wave of phishing attempts.

When faced with phishing attempts, consider these precautions:

- Remain calm; emotional responses can cloud judgment.

- Use official support channels for inquiries about suspicious emails.

- Bookmark verified sites for access, rather than clicking on links from unknown sources.

Custody Risks

When you store your cryptocurrencies on an exchange, you are essentially relinquishing control over your assets. The exchange holds your private keys, making your coins susceptible to hacking, insider theft, and additional threats beyond your influence.

In the broader financial world, high-net-worth individuals employ strategies using multiple key holders for fund access, preventing any single person from having unilateral control over significant assets. For example, distributing parts of a passcode among family members ensures that all must collaborate to access the funds, thus minimizing risks associated with theft or mismanagement.

Strengthening Security Practices

As a cryptocurrency investor, implementing robust digital security measures is crucial:

- Document your passwords on paper or engrave them on metal; avoid digital storage.

- Connect your cold wallet to the internet only when necessary, and use secure networks.

- Regularly update your cold wallet firmware exclusively from the manufacturer's official site.

- Enable two-factor authentication (2FA) wherever available.

- Consider dedicating a device solely for your cold wallet to mitigate exposure to threats.

For an intriguing take on this topic, I recommend reading this detailed article.

A Cold Wallet Alternative: Trezor

Unlike Ledger, Trezor has not experienced any hacks. One of its significant benefits is its open-source firmware, which allows for independent scrutiny of the code, thus ensuring it remains free from malicious interference. Conversely, Ledger operates on closed-source firmware, limiting third-party testing for vulnerabilities.

The Trezor Model One is priced at $69, making it more affordable than Ledger’s Nano S Plus at $79. Currently, there’s even a 15% discount, likely in response to recent controversies surrounding Ledger.

The Trezor Model T offers a larger, color touch screen, enhancing user experience. Having used it for several years, I can attest to its reliability.

While Ledger remains a solid choice, diversifying your assets across different cold wallets can enhance security.

Final Thoughts

Ledger's new service is optional, meaning users are not compelled to adopt it. Although it may provoke unease within the crypto community, it underscores the necessity of self-custody and improved digital security practices.

Remember, individuals often represent the weakest link in security protocols. Adopting preventative measures, like enabling 2FA and avoiding unsecured networks, is essential for safeguarding your assets.

While Trezor presents a viable alternative, no method guarantees absolute security. Nonetheless, implementing additional safety measures is always prudent.

I’m eager to hear your opinions. What do you think about this new feature?

Note: This should not be interpreted as financial advice. Always conduct thorough research before making financial choices.

Crypto Self-Custody is About to Go Mainstream

Crypto wallets are essential for widespread adoption.

medium.datadriveninvestor.com

Crypto Confessions — Stories That Come With Painful Lessons

Cautionary tales to help you avoid similar mistakes.

Note: This article contains affiliate links.

Subscribe to DDIntel Here.

Did Ledger Really Create A BACKDOOR?!? - A critical examination of Ledger's security measures and backup service.

Is Ledger Recover Safe? An in-depth analysis revealing the truth behind Ledger's new backup feature and its implications for users.