Why Investing Is a Long-Term Game: A Closer Look at Wealth Accumulation

Written on

Chapter 1: The Reality of Investing

Investing is often perceived as an ineffective method for quick wealth accumulation. The desire to be wealthy is typically linked to the ability to enjoy the fruits of one's labor, but the reality is that investing can significantly prolong that journey, leading to a wait that feels endless.

To gain insight into the time it takes to achieve financial success through investing, we will utilize a calculator that illustrates potential earnings over the years. Following that, we’ll explore some strategies to improve your investing approach. Let’s dive in!

A Lifetime of Investing

Imagine starting your investment journey at the age of 25 and continuing until you are 65. If you earn a salary of $40,000 annually and decide to invest 10% of your income, this translates to $4,000 invested each year. Given that the stock market has historically yielded an annual return of approximately 8.10% (adjusted for inflation), we can use these figures for our calculations.

Let’s see how long it will take before you can consider yourself wealthy!

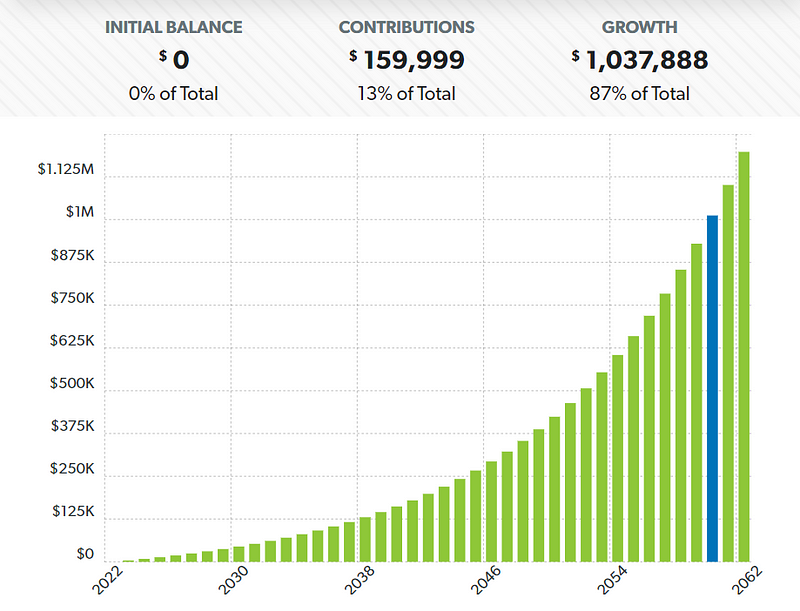

To visualize this, we can use an investment calculator:

After 40 years of consistent investing, your total would amount to $1,197,888. Yes, you’ve spent your entire adult life amassing just under a million dollars, and this figure doesn’t account for taxes. A closer look at the growth from 2022 to 2038 reveals minimal progress in the early years; the compounding effect takes time to gather momentum.

This brings us to an essential point: investing small amounts might not yield significant benefits. The returns from the initial decade of investing can be disappointingly low; thus, utilizing those funds for alternative ventures, such as launching a small online business, may be a wiser choice. Once your investment capital reaches at least $100,000, it becomes sensible to consider entering the stock market.

Nonetheless, the stock market offers more than just the prospect of millions. It provides various advantages, which we’ll delve into next.

Chapter 2: Strategies for Smarter Investing

The first video, "If You're 40 Years Old & BROKE, Do These 3 Things ASAP!" by Jaspreet Singh, highlights essential steps for those who feel financially behind. It offers practical advice for immediate changes that can set you on a path to financial stability.

In the second video, "Investing STILL Won't Make You Rich (Probably)," the discussion revolves around the realistic expectations of investing and the long-term commitment it requires.

Three Key Tips for Better Investing

The Saving Benefit

Surprisingly, the stock market can serve as an effective savings tool. Unlike traditional savings accounts that allow easy withdrawals, investing in stocks often requires selling assets—a process that can deter impulsive spending. Thus, the stock market can aid in long-term savings while potentially generating some extra income.

Consistent Monthly Investments

Benjamin Graham, a renowned investor, discovered that making monthly investments can mitigate the risks associated with annual timing. His research indicates that this strategy often leads to better returns than attempting to time the market. Regardless of market conditions, committing to invest a fixed amount monthly can improve your chances of long-term success.

Automate Your Investments

Emotional reactions can be one of the most challenging aspects of investing. When market conditions are unfavorable, panic can lead to poor decisions. One effective solution is to automate your investments. Many banks offer options for automatic monthly transfers to your brokerage account, ensuring that you continue to invest regularly, even when emotions run high.

Final Thoughts

It’s clear that investing is not a quick route to wealth. However, for those with some capital, it serves as a valuable tool for building wealth over time and can assist individuals who struggle with saving.

That wraps up our discussion! If you're interested in receiving weekly insights, feel free to join my email list for the best stories delivered to your inbox every Sunday morning—coffee not included... yet!