Embracing Minimalism: 6 Purchases I’ve Eliminated for Happiness

Written on

Chapter 1: Transformative Spending Habits

Understanding the shift in my buying habits was crucial for my financial health.

This paragraph will result in an indented block of text, typically used for quoting other text.

Section 1.1: The Journey to Financial Awareness

Reflecting on my post-college life, had I ventured out on my own immediately, I would have faced significant challenges. My financial habits were so poor that my parents encouraged me to stay at home until I secured a steady job. Four years later, after thoroughly examining my spending patterns, I moved out. I discovered that by eliminating certain purchases, I gained much more than just extra money in my bank account. Here are six things I no longer miss.

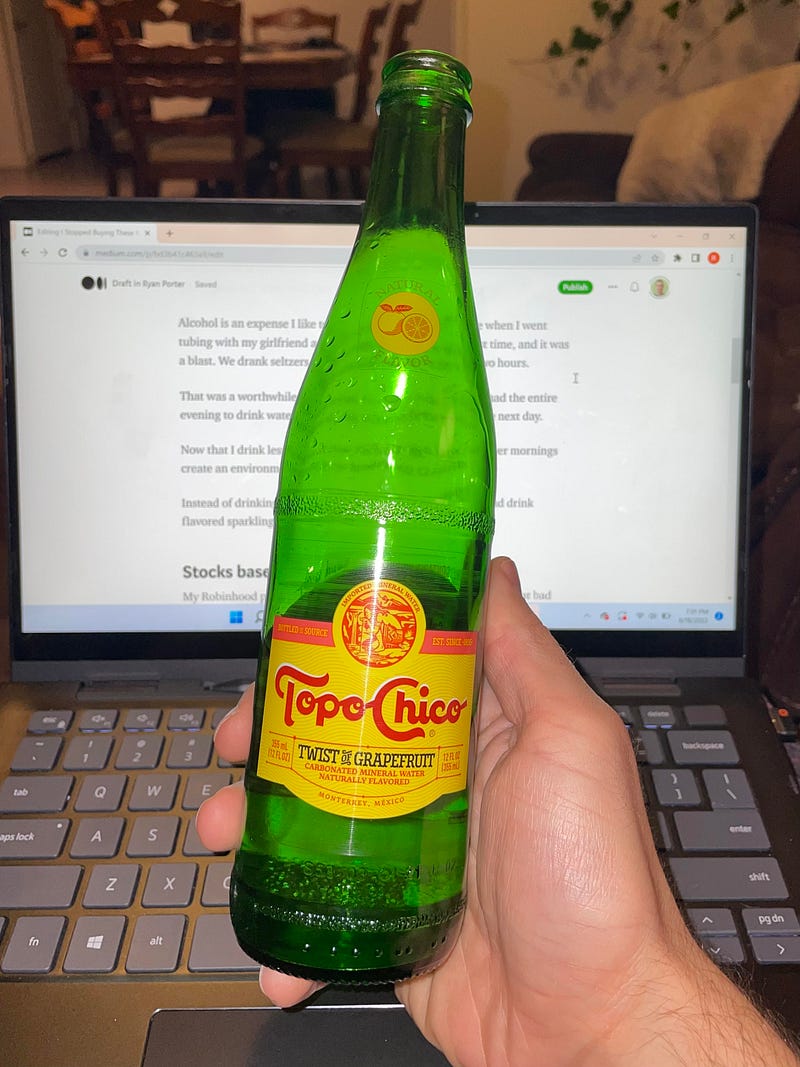

Weekday Drinking

I enjoy unwinding with a drink after a long workday, just like anyone else. However, I've come to realize that the empty calories from alcohol aren't worth it. Instead, I prefer nourishing my body with energy-rich foods. Alcohol is now reserved for special occasions, like a recent tubing trip with friends. We enjoyed refreshing seltzers while floating down the river, making it a memorable experience. Drinking less has improved my mornings, allowing for more productive days. Now, I opt for flavored sparkling water during the week—though it doesn’t give me a buzz, it’s a delightful alternative after a shift.

Section 1.2: Avoiding Hype in Investing

A few years back, during a cigar-filled evening with friends, we discussed stocks and cryptocurrency. We jumped into various small-cap stocks that seemed promising. Unfortunately, I failed to sell at the right time, and now I’m witnessing my portfolio's recovery process. I got caught up in the buzz and stubbornness. As a young adult, I learned that investing in solid companies is wise, but it's best to hold onto them until they rebound.

Chapter 2: Mindful Consumption

This video explores 24 items I’m choosing not to buy in 2024, emphasizing minimalism and saving strategies.

Section 2.1: Treating Myself Wisely

I still indulge in coffee from time to time, but not daily. I only visit coffee shops occasionally, a change from my former routine of daily lattes. Tim Denning once noted that while being smart with money is essential, enjoying life is equally important. I’m willing to splurge on a $5 nitro cold brew if it boosts my productivity during a Sunday editing session.

Section 2.2: The Pitfalls of Gambling

Living in a state with online betting is tempting. Although it can be enjoyable, the addictive nature of gambling is a slippery slope. I’ve realized that it’s better to invest in my future rather than gamble with my finances.

This video shares nine purchases I’ve stopped making to improve my financial standing.

Section 2.3: Homemade Alternatives

A specific protein shake from Whole Foods used to be my go-to treat, especially during events like Coachella. However, I discovered I could create a better, more affordable version at home. Instead of succumbing to expensive cravings, I prioritize preparing my own meals and drinks to save both time and money.

Section 2.4: Smart Grocery Shopping

Over the past ten months, I’ve developed a system for grocery shopping that minimizes waste. I used to discard a significant amount of spoiled food, particularly fresh produce. Now, I focus on buying items I can consume quickly, such as salad packs, which help me feel full and energized while also saving me money.

The Decision-Making Process

When I contemplate purchasing something, I now implement a two-week waiting period. This strategy has saved me thousands by encouraging a distinction between wants and needs. For instance, I considered buying a new camera but realized I already had two. By allowing the desire to settle, I often uncover how unnecessary many of my wants truly are.

Join a community of over 500 individuals committed to self-improvement by downloading the Effortless Blogger Blueprint for free!