ChatGPT’s Stock Picks Outshine the S&P 500: A Deep Dive

Written on

Chapter 1: ChatGPT’s Remarkable Stock Performance

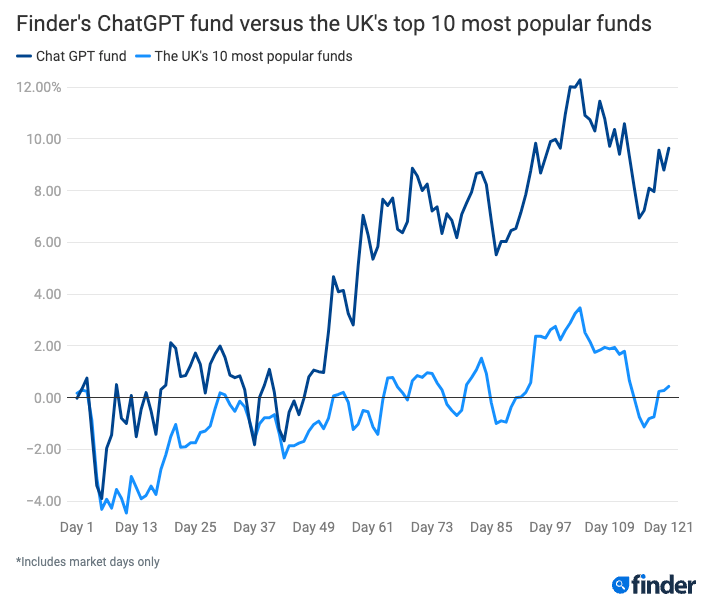

In recent times, ChatGPT, the conversational AI from OpenAI, has been making significant strides in the financial realm. A collection of 38 stocks curated by ChatGPT has surpassed both the S&P 500 and the leading 10 mutual funds in the UK. Between March 6 and August 18, the performance of the stocks selected by ChatGPT increased by 9.4%, while the S&P 500 rose by only 7.9%. Among the standout stocks in this selection are industry giants like Nvidia, Microsoft, and Alphabet, all of which have demonstrated impressive growth this year.

The financial sector is well-acquainted with the growing impact of technology, but the emergence of artificial intelligence that outperforms seasoned human analysts in stock selection raises new questions. This article examines how ChatGPT's stock choices have not only exceeded the S&P 500's returns but also outpaced the top 10 mutual funds in the UK.

Section 1.1: ChatGPT’s Exceptional Results

As per a report from the financial comparison platform Finder.com, ChatGPT's selection of 38 stocks experienced a 9.4% rise from March 6 to August 18. In contrast, the leading 10 mutual funds in the UK reported a mere 1.67% increase. Even the S&P 500, a standard benchmark for many investment funds, recorded a 7.9% gain. The AI's chosen stocks include prominent names like Nvidia, Microsoft, and Alphabet, all of which have shown robust performance.

Subsection 1.1.1: The Stock Selection Criteria

What makes this achievement even more fascinating is the methodology behind ChatGPT's stock choices. The AI utilized criteria such as minimal debt, consistent historical growth, and assets that provide a competitive edge. Notably, these criteria align with those employed by the top 10 mutual funds, underscoring the significance of the AI's accomplishments.

Section 1.2: A Note of Caution

While the results presented are encouraging, Finder.com cautions against relying on ChatGPT for financial guidance. The AI's training only extends up to September 2021 and it is not explicitly designed to dispense financial advice. A 2023 survey revealed that 8% of participants currently use ChatGPT for financial advice, and 19% would consider it. However, 35% expressed that they would avoid using ChatGPT for financial advisory services.

Chapter 2: Reflecting on the Future of Financial Advisory

The first video titled "I Just Asked ChatGPT to Pick the Best Stocks. Are they though?" explores the implications of using AI for stock selection, providing insights into ChatGPT's capabilities.

The second video, "ChatGPT vs Google Bard vs Wall Street Pro Stock Picking | BEST Stocks for 2024," analyzes the competition among various AI and human stock-picking methods, shedding light on the future of investment strategies.

Questions for Consideration

Is AI the Future of Financial Advisory? — Given ChatGPT's ability to surpass human experts, should we start viewing AI as a credible alternative for financial consultation?

Ethical Implications — Is it ethical to employ AI for making financial decisions when these systems are not specifically designed for that purpose?

Human vs. Machine — Will artificial intelligence ultimately replace human financial advisors, or will it function as a supportive tool for human decision-making?